Classiq Powers Quantum Breakthrough with Sumitomo Corporation and Mizuho-DL Financial Technology

- Achieved 95% quantum circuit compression to drive finance innovation

- Demonstrated efficiency improvements in implementing quantum algorithms for credit portfolio risk management calculations

-

Accelerating early practical applications of quantum algorithms in finance

/EIN News/ -- TEL AVIV, Israel, March 25, 2025 (GLOBE NEWSWIRE) -- Classiq Technologies, a leading quantum computing software company, announced today that it has successfully achieved significant compression of quantum circuits in implementing quantum algorithms for Monte Carlo simulations as part of a project conducted by Sumitomo Corporation. Sumitomo used Classiq's quantum platform and quantum algorithms provided by Mizuho–DL Financial Technology Co., Ltd.

Background: Expectations for Quantum Computing Implementation in Finance

In the financial industry, Monte Carlo simulations are widely used for derivative pricing and asset risk evaluation. However, these simulations require the generation of vast scenarios using random numbers, leading to high computational costs and long processing times. Quantum computing has the potential to efficiently handle large-scale probabilistic simulations compared to conventional methods, offering significant benefits in speeding up simulations and improving risk assessment accuracy.

This project explored the use of Classiq's technology to generate more efficient quantum circuits for a novel quantum Monte Carlo simulation algorithm incorporating pseudo-random numbers proposed by Mizuho-DL FT. The project aimed to evaluate the feasibility of implementing quantum algorithms in financial applications in the future.

Objective: Evaluating Hardware Resource Reduction Using Two Quantum Algorithms

Quantum Monte Carlo simulations are expected to be used in finance for risk metrics such as Value at Risk (VaR), enabling fast and accurate credit portfolio risk assessments. In this project, two types of quantum Monte Carlo simulations were implemented:

- Traditional Monte Carlo simulation

- Pseudo-random number-based Monte Carlo simulation proposed by Mizuho-DL FT

The goal of the study was to optimize quantum circuits by comparing the two simulation methods.

In traditional methods, each random number requires a dedicated quantum bit (qubit), leading to a large number of qubits. In contrast, the pseudo-random number method generates necessary random patterns in stages, significantly reducing the required qubit count. However, this reduction can lead to deeper circuits, introducing a trade-off in circuit design.

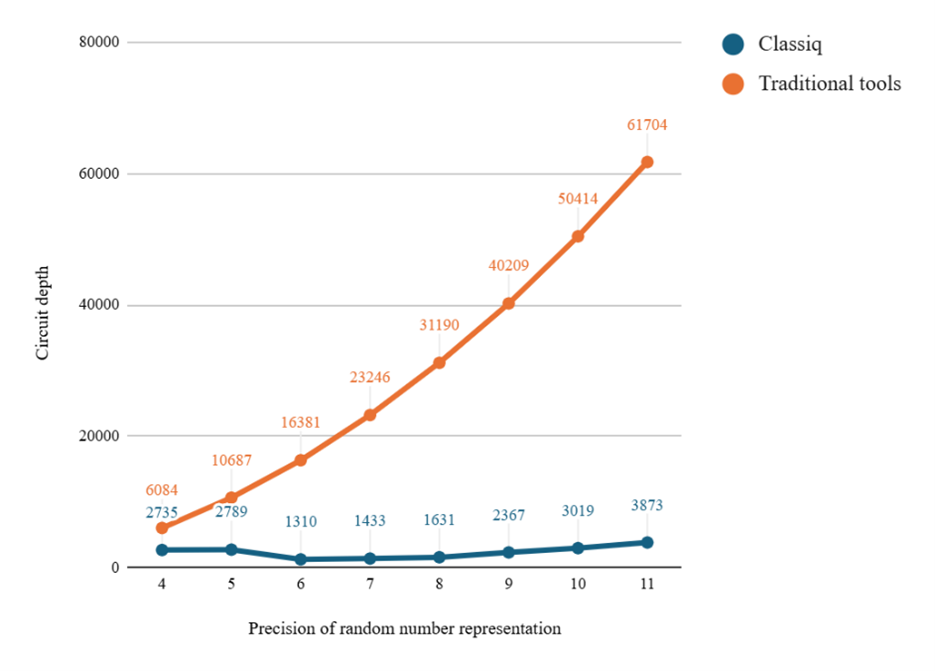

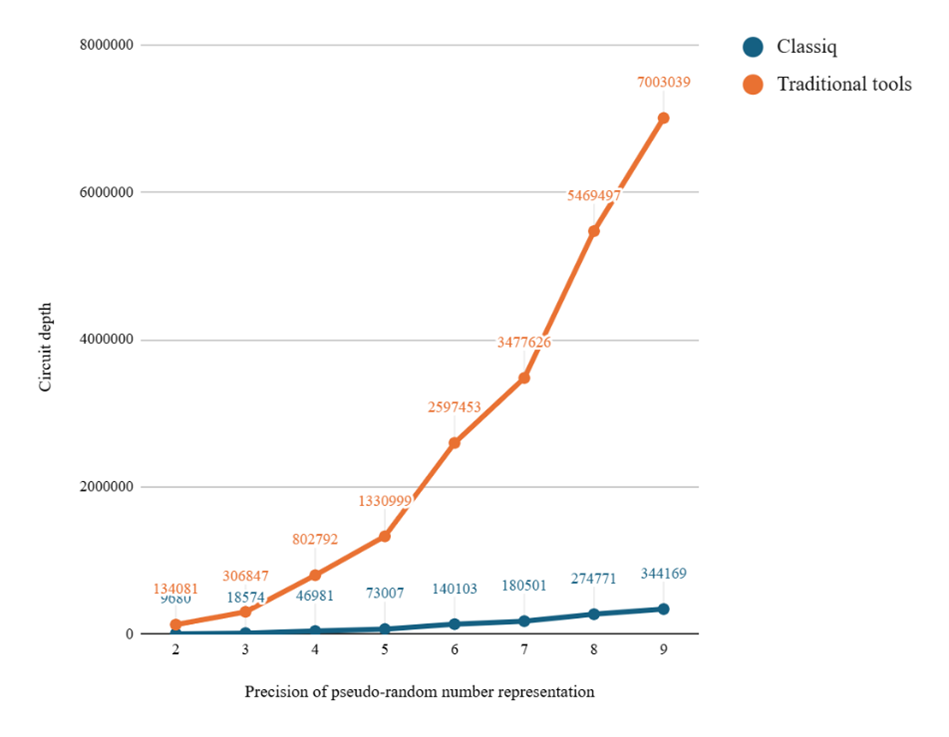

To address this, Classiq's quantum circuit compression technology was applied to assess whether the circuits generated for both types of Monte Carlo simulations could be further optimized. Specifically, quantum circuits generated with conventional techniques were compared with those designed using Classiq's high-level quantum language, Qmod. The evaluation considered qubit usage, circuit depth and computational accuracy.

The results demonstrated that both approaches achieved up to 95% compression without significantly increasing qubit count. This demonstrates the potential for efficient and high-precision risk assessment using limited quantum resources.

Results: Achieving Up to 95% Quantum Circuit Compression While Maintaining Computational Accuracy

A quantum circuit is the structured implementation of an algorithm on a quantum computer, composed of qubits and quantum gates that operate on them. The longer the quantum circuit, the greater the error rate and the higher the hardware resource consumption, making quantum circuit compression a critical challenge for improving the efficiency of quantum algorithm implementation.

In this project, significant compression was achieved in quantum circuits for two types of quantum Monte Carlo simulations designed for credit portfolio risk management. Both simulations improved computational efficiency on quantum hardware and enhanced scalability for larger financial problems.

By enabling high-precision calculations with fewer resources, the study demonstrated that large-scale probabilistic simulations for financial risk management may be feasible. Additionally, the reduced circuit depth improved fault tolerance, minimizing the impact of noise.

These findings mark a significant step toward the practical implementation of quantum computing in finance, improving the execution accuracy of quantum algorithms on quantum hardware.

Results of Quantum Circuit Compression

Figure 1: Traditional Quantum Monte Carlo Simulation – Circuit Depth

Figure 2: Pseudo-Random Number-Based Quantum Monte Carlo Simulation – Circuit Depth

Project Implementation: Sumitomo Corporation

Demonstration, Support: Classiq

Algorithm Provision: Mizuho-DL FT

About Classiq

Classiq Technologies, the leading quantum software company, provides a platform (IDE, compiler and OS) that takes you from algorithm design to execution. The high-level descriptive quantum software development environment, tailored to all levels of developer proficiency, automates quantum programming. This ensures that a broad range of talents, including those with backgrounds in AI, ML, computer science and linear algebra, can harness quantum computing without requiring deep, specialized knowledge of quantum physics. Classiq works closely with quantum cloud providers and advanced computation hardware developers providing software for use with quantum computers, HPC and quantum simulators.

Classiq’s core technology, algorithmic quantum circuit compilation, is engineered to power the quantum ecosystem of today and to scale effortlessly for the future.

Backed by investors such as HPE, HSBC, Samsung, Intesa Sanpaolo and NTT, Classiq’s world-class team of scientists and engineers has distilled decades of quantum expertise into its groundbreaking quantum engine. Follow Classiq on LinkedIn, X or YouTube, visit the Slack community, GitHub repository and www.classiq.io to learn more.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/3624976e-736b-419e-872d-0d6db3a5ccb3

https://www.globenewswire.com/NewsRoom/AttachmentNg/243a827c-0fda-447b-a984-cd93e650a093

https://www.globenewswire.com/NewsRoom/AttachmentNg/649a954b-8b29-4471-b42d-424dac4dd0ab

Media Contacts:

Emma Gielata or Michelle Allard McMahon

Rainier Communications on behalf of Classiq

classiqPR@rainierco.com

Pseudo-Random Number-Based Quantum Monte Carlo Simulation

Pseudo-Random Number-Based Quantum Monte Carlo Simulation – Circuit Depth

Traditional Quantum Monte Carlo Simulation

Traditional Quantum Monte Carlo Simulation – Circuit Depth

Sumitomo, Classiq and Mizuho Logos

Sumitomo used Classiq's quantum platform and quantum algorithms provided by Mizuho–DL Financial Technology Co., Ltd. to achieve significant compression of quantum circuits in implementing quantum algorithms for Monte Carlo simulations.

Distribution channels: Consumer Goods, Media, Advertising & PR

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release