Save Up to 50 % Off with IBN Technologies Smart Finance and Accounting Outsourcing Solutions, USA

Save up to 50% on finance & accounting outsourcing with IBN Technologies USA. Streamline operations, cut costs & stay compliant!

“As financial regulations evolve and operational expenses rise, outsourcing finance functions allows businesses to streamline processes, improve compliance, and foster sustainable growth,” said Ajay Mehta, CEO of IBN Technologies.

In-house Finance Costs Rising? Outsource to save money —Start Today!

India’s position as a global hub for finance and accounting outsourcing continues to strengthen, as businesses seek specialized expertise, advanced digital solutions, and ISO-certified providers like IBN Technologies to manage their financial operations. The shift is fueled by rapid technological advancements, stringent compliance requirements, and the increasing complexity of financial landscapes across industries.

Escalating Demand for Finance Outsourcing in a Challenging Economic Climate

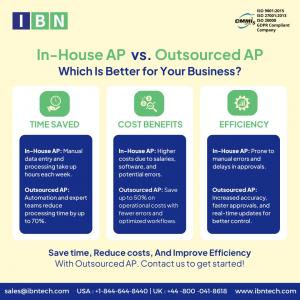

Businesses worldwide are grappling with economic volatility, regulatory tightening, and labor shortages, prompting them to seek outsourcing solutions for financial resilience. With inflationary pressures mounting and in-house financial management becoming costlier, organizations are increasingly turning to outsourced finance and accounting services to maintain agility and efficiency.

Navigating intricate tax regulations and compliance mandates has become a significant challenge for businesses. Stricter financial oversight demands continuous monitoring and adjustment, leading to increased administrative burdens. Maintaining compliance with financial reporting standards, tax laws, and audits demands significant resources, which many companies prefer to invest in growth initiatives.

Additionally, outdated financial systems and manual processes exacerbate inefficiencies, resulting in delays reporting transaction errors, and cash flow inconsistencies. Businesses experiencing rapid expansion or seasonal revenue fluctuations often struggle to scale their financial operations effectively. Outsourcing finance and accounting functions provide a streamlined, scalable solution to these challenges, ensuring improved financial forecasting, cash flow management, and risk mitigation.

Companies are leveraging outsourced finance solutions to cut costs, improve regulatory compliance, and ensure financial agility. Outsourcing eliminates the need for large in-house finance teams, reducing overhead while delivering access to skilled professionals specializing in tax preparation, payroll management, and financial reporting. This allows organizations to adapt to market shifts with greater efficiency and control.

India has solidified its position as a global hub for finance and accounting outsourcing, thanks to its skilled workforce and cost-effective service offerings. Indian finance professionals are well-versed in international accounting standards, including GAAP and IFRS, making them indispensable to businesses worldwide. Moreover, India’s time zone advantage enables seamless transaction processing and timely reporting.

“The FAO industry is witnessing significant growth, with companies like IBN Technologies providing tailored financial solutions worldwide. Our expertise, affordability, and technological advancements make outsourcing a strategic choice for global businesses” says Ajay Mehta CEO.

Outsourced finance services are now being adapted to industry-specific needs, helping businesses optimize financial management strategies. In the healthcare sector, outsourced financial solutions ensure compliance with HIPAA regulations, streamline insurance claim processing, and improve revenue cycle management. The real estate industry benefits from automated lease accounting, rental income tracking, and property tax optimization, leading to better financial transparency.

For retail and e-commerce, finance outsourcing enhances operational efficiency through multi-channel sales tax automation, inventory reconciliation, and digital payment tracking. Meanwhile, manufacturing and logistics companies leverage outsourced finance services to streamline supply chain cost management, freight invoicing, and tax compliance, reducing risks and enhancing productivity.

IBN Technologies are at the forefront of providing industry-specific financial outsourcing solutions, incorporating automation and digital tools to drive accuracy and efficiency for businesses worldwide.

A key driver of financial outsourcing growth is the adoption of cloud-based finance and accounting software. These platforms allow real-time access to financial data, automated invoicing, and encrypted transactions, enhancing security and efficiency. The outsourcing providers are integrating these technologies to deliver seamless financial management services to global clients, reducing human error and ensuring financial transparency.

Additionally, financial analytics tools are revolutionizing the way businesses interpret and utilize financial data. By leveraging predictive insights, companies can optimize budgets, enhance financial forecasting, and proactively address risks. Outsourcing firms are instrumental in helping businesses harness these tools for better decision-making and operational control.

Before your Savings Reduce! Partner with Experts to Minimize Financial Risks Today!

Outsourcing finance and accounting services is no longer just about offloading non-core tasks—it’s becoming a fundamental component of business transformation. By delegating finance functions, companies can redirect internal resources toward expansion strategies, mergers, acquisitions, and market entry initiatives. This shift allows CFOs and financial leaders to focus on strategic financial planning rather than administrative oversight.

From multinational corporations to startups and mid-sized firms, businesses are increasingly relying on outsourced finance teams for accurate financial insights, efficiency improvements, and business continuity. Given ongoing global economic uncertainties, finance outsourcing is emerging as a crucial risk-mitigation strategy.

Outsourcing a Global Perspective

The trend of outsourcing finance and accounting to India is not just growing—it’s becoming a critical strategy for businesses seeking resilience and cost efficiency. With labor shortages persisting in Western economies, companies are turning to India’s vast talent pool to access financial expertise at competitive rates.

Furthermore, Indian outsourcing firms have strengthened their service offerings by aligning with global financial regulations and implementing stringent data security measures. This ensures that businesses outsourcing to India receive high-quality, compliant, and scalable financial solutions. The ability to operate seamlessly due to India’s time zone advantage further solidifies its position as a key player in global financial services.

Despite the numerous benefits, some businesses express concerns regarding data security, compliance, and communication barriers in outsourcing financial operations. To counter these challenges, Indian outsourcing providers are investing heavily in cybersecurity measures, compliance training, and enhanced client support structures. Strict data encryption, GDPR adherence, and audit-ready financial processes ensure that sensitive information remains protected. Additionally, dedicated account management teams facilitate seamless communication and collaboration between outsourcing firms and their clients.

As businesses continue to navigate financial complexities, the demand for outsourced finance and accounting solutions is poised to rise further. The increasing integration of cloud-based accounting systems, financial analytics, and automated reporting tools is reshaping the way companies manage their financial functions.

As global businesses continue to navigate economic uncertainties and regulatory complexities, the demand for finance and accounting outsourcing is set to rise further. Companies are increasingly turning to expert providers like IBN Technologies to drive efficiency, ensure compliance, and leverage cutting-edge digital solutions. With India’s strong outsourcing ecosystem and a growing emphasis on technological advancements, the FAO industry is poised for sustained growth, shaping the future of financial management worldwide.

Sources:

Outsourcing Finance and Accounting Services | IBN Technologies

https://www.ibntech.com/article/outsourced-finance-and-accounting-services-usa/?pr=EIN

Explore More Services:

USA Bookkeeping Services:

https://www.ibntech.com/bookkeeping-services-usa/?pr=EIN

Account Payable and Account Receivable Services:

https://www.ibntech.com/accounts-payable-and-accounts-receivable-services/?pr=EIN

Tax Filing in the United States Guide

https://www.ibntech.com/article/us-tax-filing-2025-guide/?pr=EIN

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 25 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022, CMMI-5, and GDPR standards. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive efficiency and growth.

Pradip

IBN Technologies LLC

+1 844-644-8440

sales@ibntech.com

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Distribution channels: Business & Economy

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release