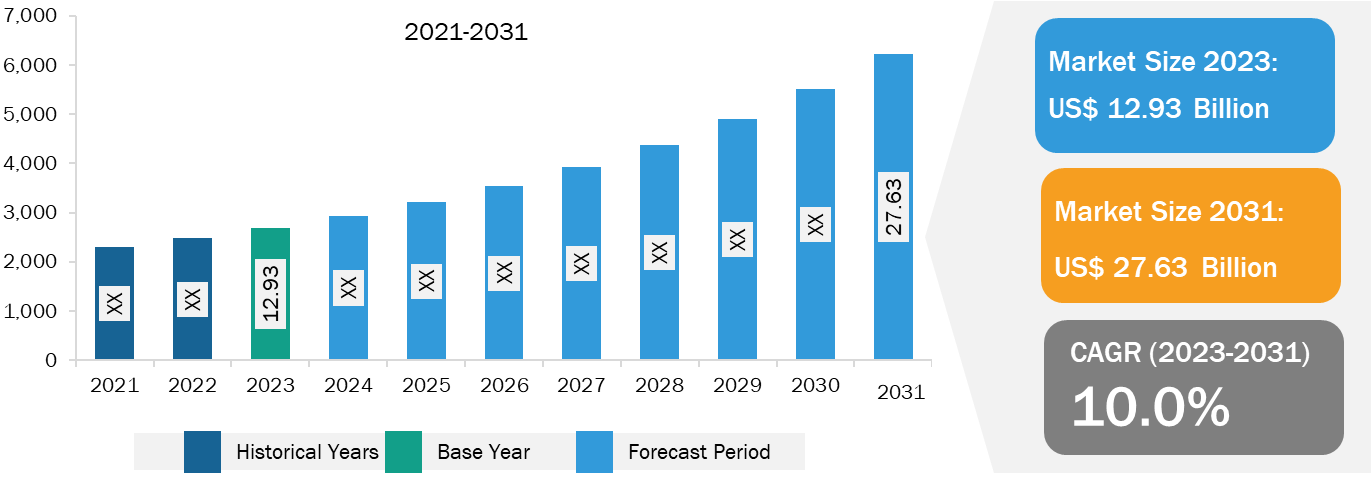

Military Drone Market Size Worth $27.63 Billion, Globally, by 2031 - Exclusive Report by The Insight Partners

Military Drone Market size US$ 12.93 billion in 2023 with anticipated to register CAGR of 10.0% 2031. Includes key company profiles like are Lockheed Martin Corp, Northrop Grumman Corp, Thales SA, Boeing Co, Elbit Systems Ltd, General Atomics, Textron Systems Corp, BAE Systems Plc, AeroVironment Inc

/EIN News/ -- US & Canada, Jan. 30, 2025 (GLOBE NEWSWIRE) -- According to a new comprehensive report from The Insight Partners, “the global Military Drone Market Size and Forecast (2021 - 2031), Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type (Group 1, Group 2, Group 3, Group 4, and Group 5), Application (ISR, Warfare, and Others), Range (Short Range, Medium Range, and Long Range), Technology (Fixed Wing and Rotary Wing) and Geography”.

For More Information and To Stay Updated on The Latest Developments in The Military Drone Market, Download The Sample Pages: https://www.theinsightpartners.com/sample/TIPRE00029692/

The report runs an in-depth analysis of market trends, key players, and future opportunities. The demand for military drones is expected to grow during the forecasted period due to an increase in the use of electronics into military forces. Also, advancements in artificial intelligence and machine learning, and their integration with drone systems allow drone manufacturers to glorify their portfolios. Their state-of-the-art products enable real-time, data-driven decision-making by enabling high-speed data capture and processing.

Market Overview and Growth Trajectory:

Military Drone Market Growth: The military drone market is expected to reach US$ 27.63 billion by 2031 from US$ 12.93 billion in 2023; it is expected to record a CAGR of 10.0% during the forecast period. In the military sector, drones are used in applications such as intelligence, surveillance, and reconnaissance (ISR); electronic warfare; coordination and transportation; and research and surveying. Drones can be remotely operated, and equipped with various sensors and weapons, which has added to their popularity in military applications. Moreover, their remote operations lead to the increased safety of personnel operating them; they are not exposed to risks associated with traditional warfare. In addition, the use of drones reduces the need for ground troops, which can significantly reduce the number of casualties and related expenses.

For Detailed Market Insights, Visit: https://www.theinsightpartners.com/reports/military-drone-market

Rising Number of Contracts for Military Drones: One of the major factors driving the growth of military drone market is increasing number of contracts from different military forces worldwide. Some of them are mentioned below:

In December 2022, the UK Ministry of Defense awarded Lockheed Martin Corporation a contract with the evaluation of US$ 157 million to supply more than 250 mini-drones for the British Army. Under the 10-year agreement, the company delivered 159 rotary-wing Indago 4 drones and 105 fixed-wing Stalker VXE30 drones to replace the army's Desert Hawk 3 mini-drones.

In March 2021, Textron received a contract worth up to US$ 607 million from the US Army. Under this contract, Textron provided the contractor logistics support, field services, and engineering support, along with retrofitting their existing Shadow Block II Tactical Unmanned Aircraft System (TUAS) to the upgraded Block III configuration.

In April 2022, the French Defense Procurement Agency (DGA) awarded a contract to a consortium led by Thales and CS group to develop a counter-unmanned aerial vehicle (C-UAV) system.

In January 2021, Israel Aerospace Industries Ltd signed two deals to sell and lease, respectively, two Heron MK II UAV systems to a central Asian country. Although the exact deal value is not known, the deals were valued at tens of millions of US dollars. The systems include reconnaissance payloads, Heron MK II drones, and land arrays.

In March 2023, Northrop Grumman Corporation, teamed with Shield AI, was chosen by the US Army to participate in the future tactical unmanned aircraft system (FTUAS) competition—Increment 2—to replace the long-serving RQ-7B Shadow TUAS.

In March 2023, Northrop Grumman, a US-based defense giant, won the Triton drone sustainment contract, which is valued at US$ 57 million. The deal also requires continued field service to ensure the MQ-4C Triton surveillance aircraft are mission-ready for the US Navy and the Australian government.

Companies in the military drones market continuously engage in new product launched to cater to the demand from military authorities of different countries. For instance, in January 2023, Israel Aerospace Industries (IAI) launched ‘Point Blank’, a loitering munition drone, for US military under a multimillion-dollar contract between the US Department of Defense (DoD) and Israel government owned IAI. Such product launches by military drones market players will trigger a number of contracts from the different countries, thereby boosting the market growth in the forecasted period.

Stay Updated on The Latest Military Drone Market Trends: https://www.theinsightpartners.com/sample/TIPRE00029692/

Surging Military Expenditure: The evolving modern warfare scenario has compelled governments of various countries across the globe to assign significant funds and financial aid toward respective defense and military forces. The defense budget allocation supports army and military forces to obtain enhanced technologies and equipment from domestic or international developers. On the other hand, military and army vehicle upgrades are on the rise owing to growing defense budget allocation. Furthermore, the increasing governmental expenditure showcases governments' focus on strengthening national security forces. There is an increased need to reinforce military and border security forces with advanced surveillance, communication, navigation equipment, artilleries, armaments, and vehicles, among others; hence, military forces worldwide are focusing on investing significant amounts in procuring artillery systems and other advanced technologies. Defense forces' constant inclination to acquire new technologies for noncombat and combat operations further boosts military expenditure worldwide. As per the Stockholm International Peace Research Institute (SIPRI), global military expenditure increased to US$ 2443 billion in 2023, representing a 13.7% increase from 2022. The US, China, India, Russia, and Saudi Arabia were the top five spenders in 2023, accounting for around 61% of global expenditures.

Use of Drones in Military Cargo Operations: The use of drones in military cargo has expanded into several critical areas of operations, providing a variety of benefits for armed forces across the globe. Some of the most prominent applications that is boosting the adoption of drones into military cargo operations include resupply missions in remote areas, emergency medical supply drops, ammunition and equipment resupply, and heavy cargo transportation.

Geographical Insights: In 2023, North America led the market with a substantial revenue share, followed by Asia Pacific and Europe, respectively. Asia Pacific is expected to register the highest CAGR during the forecast period.

Need A Diverse Region or Sector? Customize Research to Suit Your Requirement:

https://www.theinsightpartners.com/inquiry/TIPRE00029692/

Military Drone Market Segmentation, Applications, Geographical Insights:

- Based on type, the military drone market is segmented into group 1, group 2, group 3, group 4, and group 5. The group 5 segment held the largest market share in 2023.

- Based on application, the military drone market is divided into ISR, warfare, and others. The ISR segment held a larger share of the market in 2023.

- Based on range, the military drone market is divided into short range, medium range, and long range. The medium range segment held the largest share of the market in 2023.

- Based on technology, the military drone market is divided into fixed wing and rotary wing. The fixed wing held ta larger share of the market in 2023.

Key Players and Competitive Landscape:

The Military Drone Market is characterized by the presence of several major players, including:

- Lockheed Martin Corp

- Northrop Grumman Corp

- Thales SA

- Boeing Co.

- Elbit Systems Ltd

- General Atomics

- Textron Systems Corp

- BAE Systems Plc

- AeroVironment Inc

- Israel Aerospace Industries Ltd.

These companies are adopting strategies such as new product launches, joint ventures, and geographical expansion to maintain their competitive edge in the market.

MILITARY DRONE Market Recent Developments and Innovations:

- " Lockheed Martin recently unveiled a counter-unmanned aerial system (C-UAS) interceptor."

- " Lockheed Martin released its next-generation Indago 4 quadcopter."

- " Aerovironment Inc completes acquisition of Arcturus UAV"

- " IAI signed an agreement to acquire 50% of the equity of BlueBird Aero Systems."

"Don't Delay, Purchase Today! – Purchase Premium Copy of Global Military Drone Market Size and Growth Report (2023-2031)at: https://www.theinsightpartners.com/buy/TIPRE00029692/

Conclusion:

North America led the global military drone market in 2023. Based on country, the military drones market is segmented into the US, Canada, and Mexico. AeroVironment, Inc.; AEROVEL CORPORATION; and Textron Systems are among the key military drone manufacturers present in North America. Various companies are developing military drones for different applications. For instance, in December 2022, General Atomics launched an "Eaglet" drone from a US Army-owned Gray Eagle extended range unmanned armed system (UAS). This is the first mid-air drone launch, expected to strengthen the US defense sector. This Eaglet concept extends the capabilities of military drone's launching platforms and creates the opportunity for its launch in swarms' network during a war, further strengthening the defense sector.

Many regional drone manufacturers are upgrading their existing kamikaze drones. Kamikaze drones are packed with explosives, and they help destroy the enemy. In March 2023, AeroVironment, Inc. launched the newest version of Switchblade 300 (a kamikaze drone), named Switchblade 300 Block 20, with new operational features such as a new tablet-based Fire Control System. In addition, it is a lightweight and precision-guarded drone that can be deployed in less than 2 minutes via tube launch, improving mission flexibility. These features boost the drone's performance and capability improvements, contributing to its demand.

Related Report Titles:

- Civil Drones Market Size and Growth 2031

- LiDAR Drone Market Strategies, Top Players, Growth Opportunities, Analysis and Forecast by 2031

- Tethered Drone Market Overview, Growth, Trends, Analysis, Research Report (2021-2031)

- Commercial Drone Market Regional Share, Size, Trends, and Forecast by 2031

-

Agriculture Drone Market Drivers, Opportunities, Trends, and Forecasts by 2031

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

Contact Us:

If you have any queries about this report or if you would like further information, please contact us:

Contact Person: Ankit Mathur

E-mail: ankit.mathur@theinsightpartners.com

Phone: +1-646-491-9876

Site: https://www.theinsightpartners.com/

Distribution channels: Banking, Finance & Investment Industry, Business & Economy, Media, Advertising & PR, Science ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release