Whales with a lot of money to spend have taken a noticeably bullish stance on Accenture.

Looking at options history for Accenture ACN we detected 9 trades.

If we consider the specifics of each trade, it is accurate to state that 55% of the investors opened trades with bullish expectations and 22% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $351,608 and 5, calls, for a total amount of $214,941.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $235.0 and $345.0 for Accenture, spanning the last three months.

Insights into Volume & Open Interest

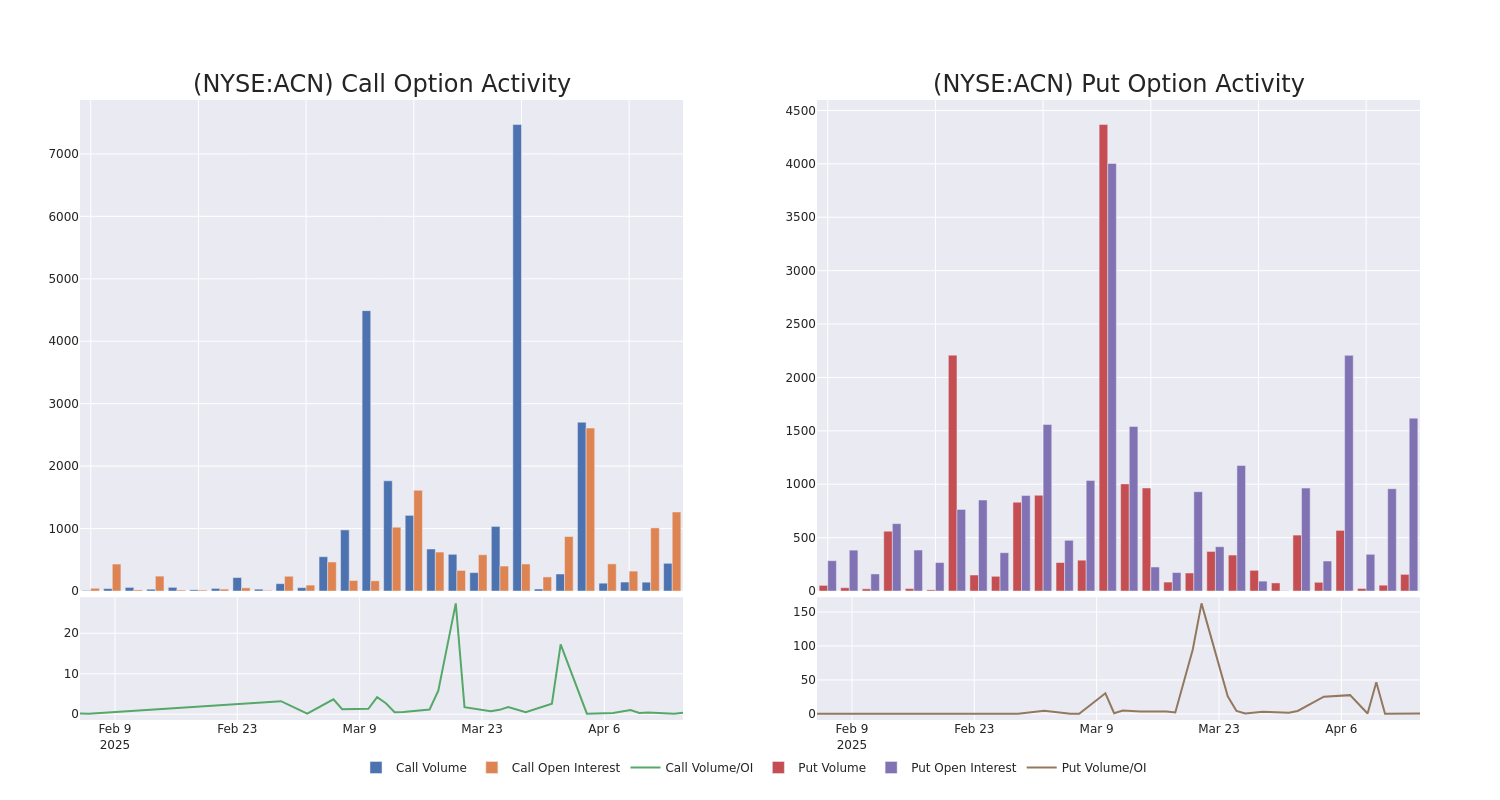

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Accenture's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Accenture's substantial trades, within a strike price spectrum from $235.0 to $345.0 over the preceding 30 days.

Accenture Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ACN | PUT | SWEEP | BEARISH | 06/20/25 | $20.1 | $19.3 | $20.1 | $300.00 | $160.6K | 524 | 82 |

| ACN | PUT | TRADE | BULLISH | 09/19/25 | $22.3 | $21.9 | $21.9 | $290.00 | $96.3K | 692 | 64 |

| ACN | CALL | SWEEP | NEUTRAL | 09/19/25 | $24.6 | $24.3 | $24.48 | $290.00 | $66.1K | 102 | 28 |

| ACN | PUT | TRADE | BEARISH | 05/16/25 | $56.0 | $53.7 | $56.0 | $345.00 | $56.0K | 64 | 10 |

| ACN | CALL | SWEEP | BULLISH | 06/20/25 | $1.65 | $1.6 | $1.6 | $340.00 | $51.3K | 480 | 339 |

About Accenture

Accenture is a leading global IT services firm that provides consulting, strategy, and technology and operational services. These services run the gamut from aiding enterprises with digital transformation to procurement services to software system integration. The company provides its IT offerings to a variety of sectors, including communications, media and technology, financial services, health and public services, consumer products, and resources. Accenture employs just under 500,000 people throughout 200 cities in 51 countries.

After a thorough review of the options trading surrounding Accenture, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Accenture

- With a volume of 1,420,812, the price of ACN is down -0.29% at $288.95.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 66 days.

Professional Analyst Ratings for Accenture

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $387.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Piper Sandler persists with their Overweight rating on Accenture, maintaining a target price of $364. * Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Accenture with a target price of $390. * Maintaining their stance, an analyst from RBC Capital continues to hold a Outperform rating for Accenture, targeting a price of $392. * Consistent in their evaluation, an analyst from Mizuho keeps a Outperform rating on Accenture with a target price of $398. * Maintaining their stance, an analyst from Guggenheim continues to hold a Buy rating for Accenture, targeting a price of $395.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Accenture, Benzinga Pro gives you real-time options trades alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.