Breaking News:

U.S. Offshore Oil Production Set To Jump

While shale oil offers flexibility,…

OPEC+ Takes Aim at U.S. Shale, Again

Reports suggest OPEC+ may boost…

Saudi Aramco Makes 14 New Discoveries as Oil Prices Bite

Saudi Aramco, the Kingdom’s giant national oil company, on Wednesday, announced the discovery of 14 new oil and natural gas that could add over 80 million cubic feet of gas per day and over 8,000 barrels of oil per day to Saudi Arabia’s fossil fuels expansion efforts, Arab News reports.

The discoveries were made primarily in the Eastern Region and the vast Empty Quarter, with a mix of oil and gas reservoirs identified, and while moderate in volume compared to the Kingdom’s vast reserves, analysts are heralding this as a signal that expansion is real and moving forward.

The Saudis are also pursuing technological advancements to further enhance extraction.

As of February 2025, Saudi Arabia's crude oil production stood at nearly 9 million barrels per day, reinforcing its dominant role in the global energy market.

However, the current price environment could impede expansion and technological advancement.

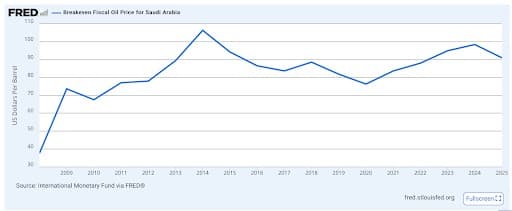

Back in November, Saudi Arabia’s 2025 fiscal breakeven price per barrel of oil was estimated at $90 by the International Monetary Fund (IMF).

As of Wednesday, April 9, at 12:12 p.m. ET, Brent crude was trading at only $60.38, while the OPEC Basket price was $66.54.

Saudi Arabia, the key OPEC+ producer, began easing output cuts on April 1, and plans to add 138,000 bpd to global oil supply this month.

The Kingdom anticipates $342 billion in expenditures in its 2025 budget, while revenues are expected to come in lower, at $316 billion, indicating a $27-billion deficit, or around 2.3% of GDP. To make up for the shortfall, Riyadh plans to issue more debt this year.

In the meantime, the Kingdom is also making a petrochemicals expansion push.

On Wednesday, Aramco announced a new deal to expand its petrochemical complex on the west coast of the kingdom, signed with China Petroleum & Chemical Corporation (Sinopec) and Yanbu Aramco Sinopec Refining Company (Yasref).

The Yasref complex, in which Aramco holds a 62.5% stake and Sinopec owns 37.5%, will see the addition of a new petrochemical unit. This will include a large-scale mixed feed steam cracker with an annual capacity of 1.8 million tonnes, alongside a 1.5 million tonnes per year aromatics complex, Arab media reports.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com

- Job Numbers Rise in Alaska’s Arctic Thanks to Oil Projects

- Cautious Calm in Canada’s Oil Patch as Prices Slide

- Live: Oil Prices Crash Below $60 as Tariff War Reaches Boiling Point

ADVERTISEMENT

Tom Kool

Tom majored in International Business at Amsterdam’s Higher School of Economics, he is Oilprice.com's Head of Operations

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B